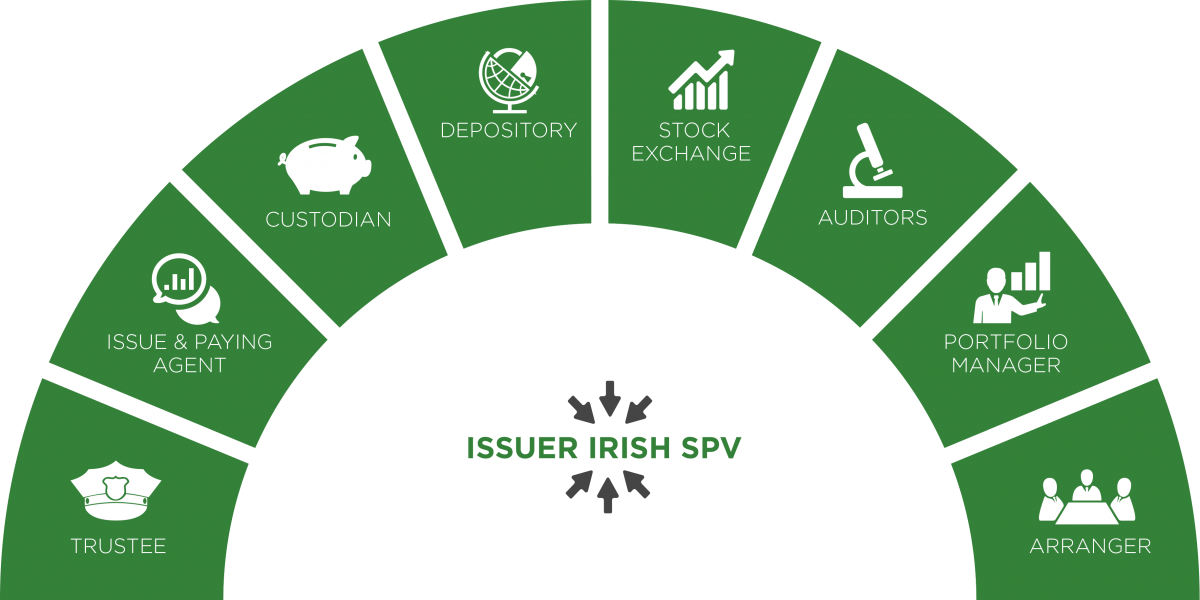

TRUSTEE

The Law Debenture Group

Founded in 1889, The Law Debenture Group is one of the oldest companies listed on the London Stock Exchange (ticker : LWDB).

Acting independently from the Issuer and the Arranger as Trustee to the Programme, Law Debenture protects the interests of the investors holding the Notes.

ISSUE & PAYING AGENT

CACEIS Investor Services

CACEIS is a European leader in asset servicing and one of the major players worldwide. Part of Credit Agricole group, CACEIS has 2.7 trillion USD under custody as of 31/12/17.

Acting as the Issue Agent, CACEIS converts the documentation into a tradeable bond with an ISIN code. In its role as Paying Agent, CACEIS monitors and manages independently all the payments (interests / redemption / maturity) made by the Issuer to the investors.

CUSTODIAN

CACEIS Bank or Interactive Brokers

For Notes which are backed by a portfolio of listed assets, CACEIS and other custody solutions are available.

DEPOSITORY

Euroclear/Clearstream

All the Notes issued by the issuer can be purchased via Euroclear/ Clearstream, ensuring easy process and settlement through one of the world's leading providers in cross-border and domestic settlement.